After furnishing all details in the ITR Utility and validating the same, you can directly upload your Income Tax Return through the Java utility by logging in your account on the income tax website through the Java Utility itself.

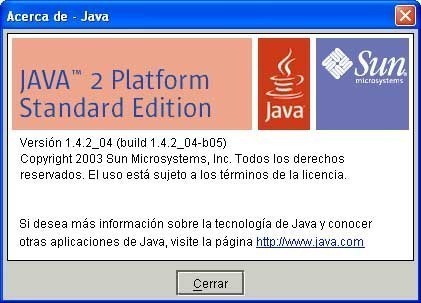

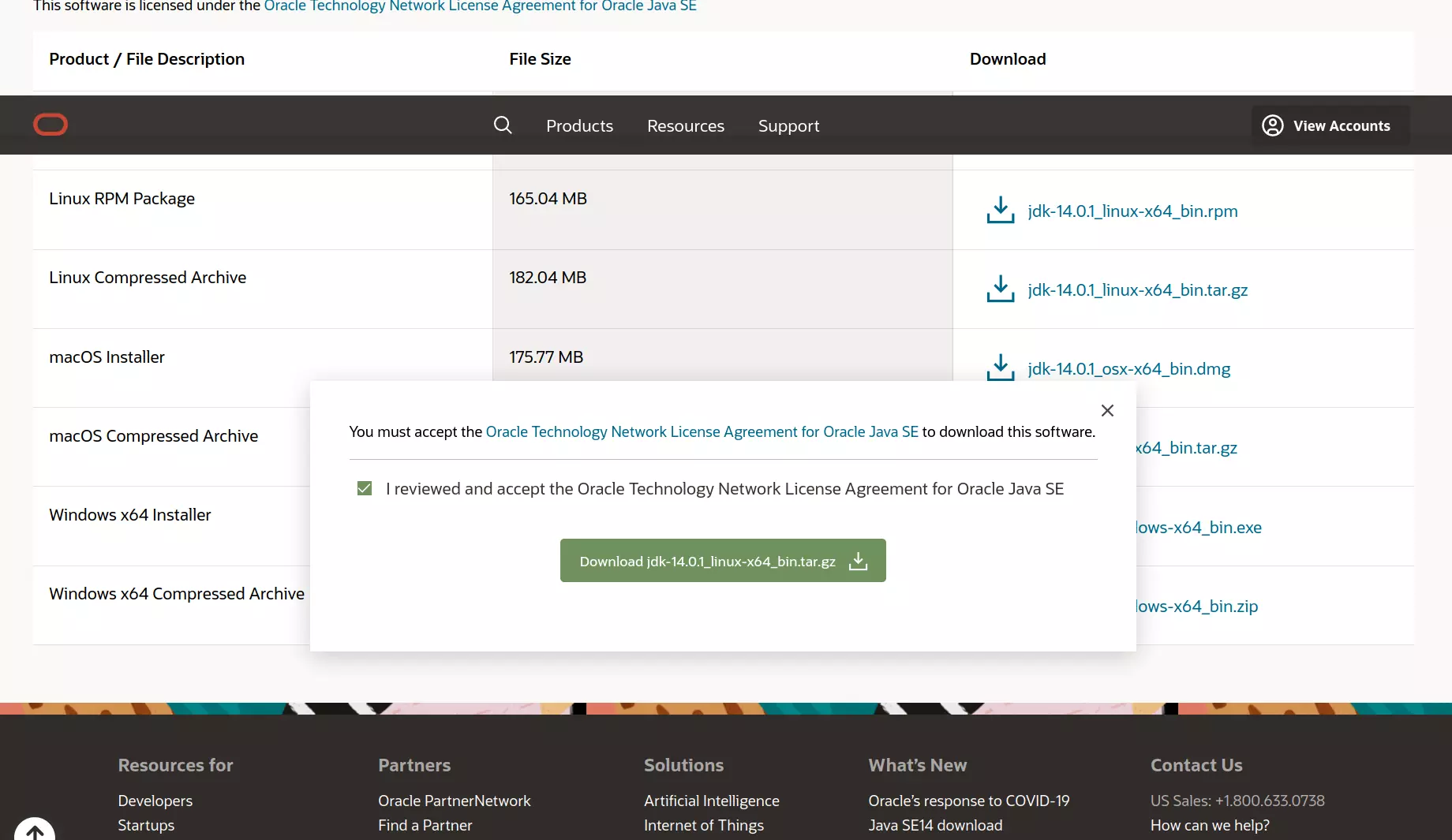

Download the ITR Java/ Excel Utility which pertains to your Income Tax Form and furnish all details in the ITR Java Utility and also cross check the same with the figures as mentioned in your Form 16/ Form 16A/ Form 16B and Form 26AS.Recommended Read: Which Income Tax Form should you use? There are various different Income Tax Return forms for different class of assessees. Logon to and select the Income Tax Return Form for your type of Income.The following Article are the steps involved for Income Tax efiling by downloading the Java/ Excel Utility:. Earlier, only the tax utility was released but now the Govt also releases a Java Utility which is much easier to file than the Excel Utility as it fetches a lot of details automatically and uploading the returns through the Java Utility is also much easier. The Java Utility is a new type of utility and is much easier to file than the Excel Utility. The Income Tax Software is released both in the form of Excel as well as Java Utility. The Income Tax Department releases an updated income tax software for free every year for income tax efiling online. Procedure for Income Tax efiling using ITR Java Utility/ ITR Excel Utility Income Tax efiling without downloading the Java Utility and furnishing all details online itself.Income Tax efiling by downloading the ITR Java utility or the ITR Excel Utility and furnishing details in the excel utility offline and then uploading it on Income Tax Website.Income Tax efiling can be done online through the Income Tax Website without any cost in 2 different ways:.

0 kommentar(er)

0 kommentar(er)